By Dan Franklin, Director of Commercial Real Estate, River City Bank

What’s going to happen with interest rates? Should I lock in now? These are common questions posed to bankers, who are ostensibly experts on the topic. While we can share some key considerations to help optimize the outcome of your decision, such as those presented below, the truth is that we just can’t predict what will happen with long term rates. While the direction of short-term interest rates is often quasi-predictable by using the guidance from the Federal Reserve Board, for example, this is much less the case with long-term rates (e.g. the 10-year treasury note yield) which are driven by market forces.

The challenge is that the U.S. Treasury market is one of the most efficient markets in the world as it’s heavily traded and the market participants are highly informed, sophisticated investors such as banks, corporations, large investment firms and foreign governments. A highly efficient market, in theory, should have prices that reflect all available information and are therefore already priced appropriately. So how does a real estate investor or banker have an edge in predicting this market when effectively competing against this large group of sophisticated investors? Unfortunately, we don’t. Sometimes we bet on interest rates and get it right, but sometimes in Vegas, I win at craps…that doesn’t mean I had an advantage in the game though; I was just gambling and got lucky.

This of course is very different than the CRE markets, which are much less efficient due to: (a) the heterogenous nature as every CRE asset is unique, (b) the much smaller number of participants willing to transact on a given asset, and (c) not all information about a piece of CRE is widely known or disclosed. As such, our clients can, and often do, have a clear advantage in the CRE markets.

So, how should one approach interest rate lock decisions? Although difficult to predict the future direction of rates, several key factors should still be considered in arriving at a decision:

1. Is there a prepayment premium on your existing loan?

If so, and it exceeds the net interest savings from a refinance, consider holding off on the refinance. The expected value of betting on rates is essentially $0 (if you subscribe to the above efficient market argument). However, a prepayment premium is a guaranteed expense, so the net “expected value” of the decision would be negative. On the other hand, if the net interest savings generated by refinancing exceed the prepayment premium, refinancing could be a good option.

2. Shape of the yield curve

If the yield curve is downward sloping, the market is anticipating that rates will fall in the future. Of course, that’s not guaranteed to happen, but in this circumstance, delaying a refinance may have a higher probability of being in a borrower’s favor. If it’s upward sloping (the more common and current shape), then, all else the same, there probably isn’t a good reason to delay a refinance.

3. Stagger your loan maturities

For borrowers with multiple properties and multiple loans, consider staggering the maturities of your fixed interest rates to mitigate the risk of being in the market for a massive amount of debt during an inopportune time (e.g. a recession when credit spreads have spiked and/or credit availability is scarce). This is similar to laddering CD investments, only applied to the liability side of your balance sheet.

4. Super low rates / government intervention

There are times when the efficient market hypothesis may fall off the rails, such as the government’s massive intervention in the Treasury markets in response to the COVID-19 pandemic, which helped drive Treasury yields below 1% for most of 2020. When rates get that low, CRE borrowers don’t tend to get the full benefit of further Treasury yield declines as lenders tend to raise spreads and/or set interest rate floors as Treasury yields fall further, which is exactly what we saw in 2020. Therefore, once rates get that low, it’s usually a good idea to seize the day and lock in.

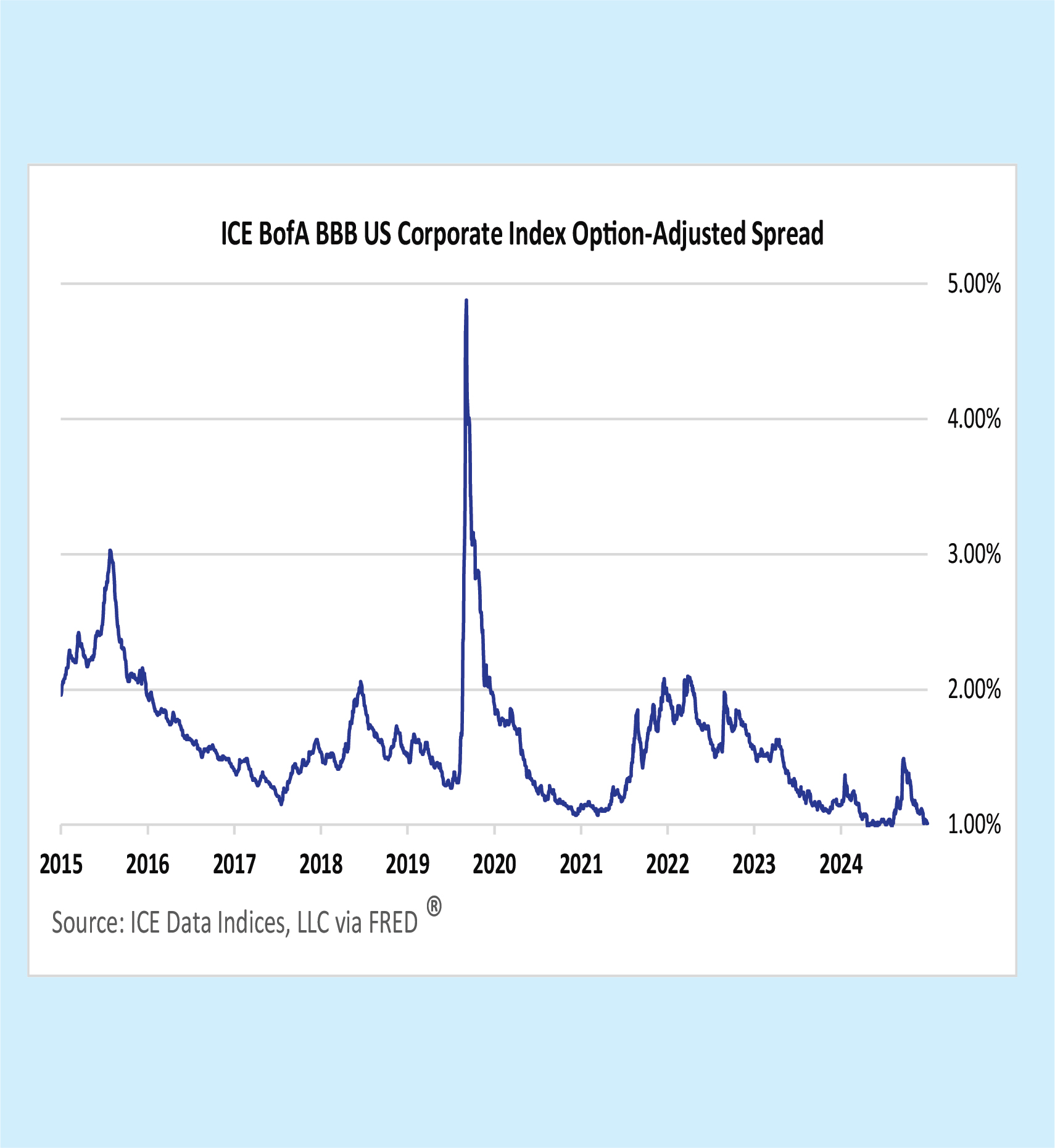

5. Credit spread levels

CRE fixed interest rates tend to be the sum of (a) Treasury yields and (b) credit spreads. In practice, the credit spread for a given loan is set by each lender in a somewhat non-formulaic way. However, because CRE loans are often a substitute investment for publicly traded bonds for the largest institutional lenders, CRE loan credit spreads are correlated with corporate bond spreads. As shown below, there is a resistance level just above a 1.00% credit spread for BBB corporate bonds. In other words, once credit spreads approach that level, it’s unlikely they’ll go any lower, and it may be a good time to lock in a CRE interest rate. They happen to be at that low level now.

With all these considerations in mind, does it still make sense for you to refinance? If so, reach out to your River City Bank contact. With credit spreads down and River City Bank’s commitment to being a low-price leader, we look forward to helping you minimize your interest expense.