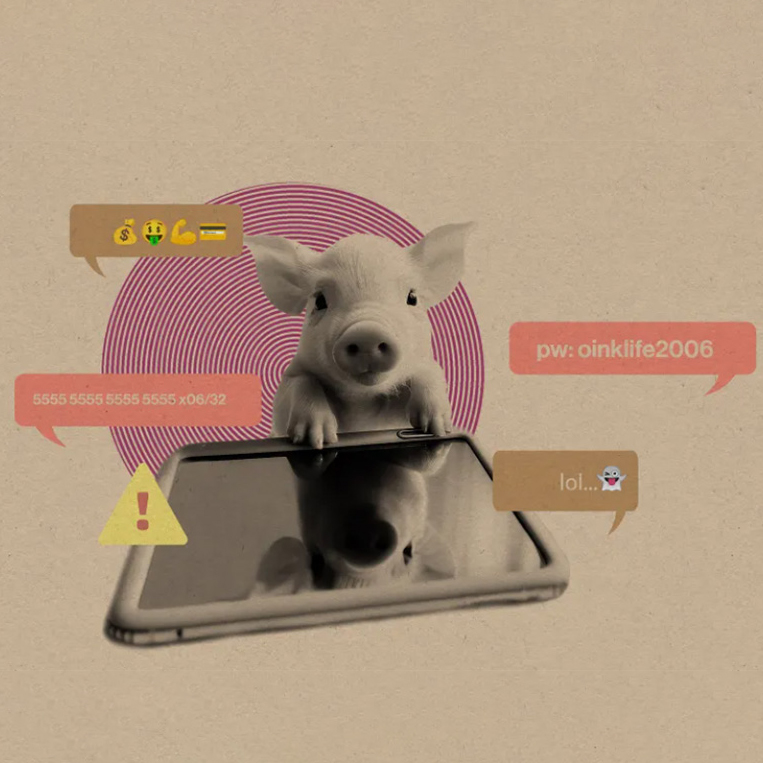

With debit cards quickly becoming the most popular form of payment around the globe, it’s no wonder that card fraud is on the rise. Almost everyone who has a debit card may have, at some point, experienced a form of information breach. But, there are things you can do to reduce the chances of becoming a victim:

Be Wary of Independent ATMs – Independent ATMs are not monitored as regularly as bank ATMs.

- Avoid using ATMs with unusual signage, especially ones requesting you enter your PIN twice to complete a transaction.

- Watch out for ATMs that appear to have been altered. If the front of the machine looks crooked, loose, or damaged; these are tell-tale signs of the existence of a skimming device.

- Cover the keypad with your other hand to block anyone, or a camera, from viewing your PIN.

Paying at the Pump – Gas station self-service pumps are easy targets for thieves to place a skimmer and/or pinhole camera. These cameras are sometimes used in conjunction with card skimmers to capture footage of customers entering their PIN.

- Pay attention to the card slot. If a card slot looks different from the other card readers at the station, it might be a setup for a card skimmer.

Take the extra step of precaution and pay the gas station attendant instead.

Online Purchases – Debit cards are accepted almost everywhere credit cards are taken. Here are a few tips to help ensure a safe online shopping experience:

- Don’t store your debit card information on websites.

- Install a personal firewall, plus antivirus and anti-spy software.

- Use strong passwords and change them regularly.

- Monitor your accounts and check your balances often.

Public WiFi – If you use a free Wi-Fi connection in an airport, café, hotel, or some other public space, you are taking a risk with your debit card information. Public Wi-Fi and shared computers are easy marks for hotspot hackers and a dangerous place to manage your banking and finances online.

- Don’t set up your devices to automatically connect to WiFi.

- When using public WiFi or a shared computer, avoid transactions that require you to enter your personal information.

Signing Your Card – As a best practice, instead of signing your card, take an indelible marker and write “Ask for identification” in block letters. If you suspect that you have been a victim of fraud or identity theft, please visit www.identitytheft.gov. This is a site run by the Federal Trade Commission that provides a step-by-step recovery plan and assistance in taking action.

Should you have any questions or concerns, please contact our Customer Service Department (916) 567-2899 or (800) 564-7144 or visit your nearest branch.