By Dan Franklin, Director of Commercial Real Estate, River City Bank

Following a 0.25% reduction in September, the Federal Reserve is highly anticipated to cut its Fed Funds rate by another 0.50% before year end with additional cuts expected in 2026. While this is broadly seen as good news for commercial real estate, the implications vary widely depending on the investor profile and debt structure. Let’s explore the impact on a few primary categories of investors.

Long Term Holders of Stabilized Assets Who Use Medium Term (5 to 10 Years) Fixed Rate Financing

Benefits for this group may end up being modest and stemming primarily from (1) general improvements in broader economic conditions often correlated with low-rate environments, and (2) slight cap rate compression as investors become dissatisfied with lower yields on money market/fixed income instruments and re-allocate capital to higher yielding investments such as CRE.

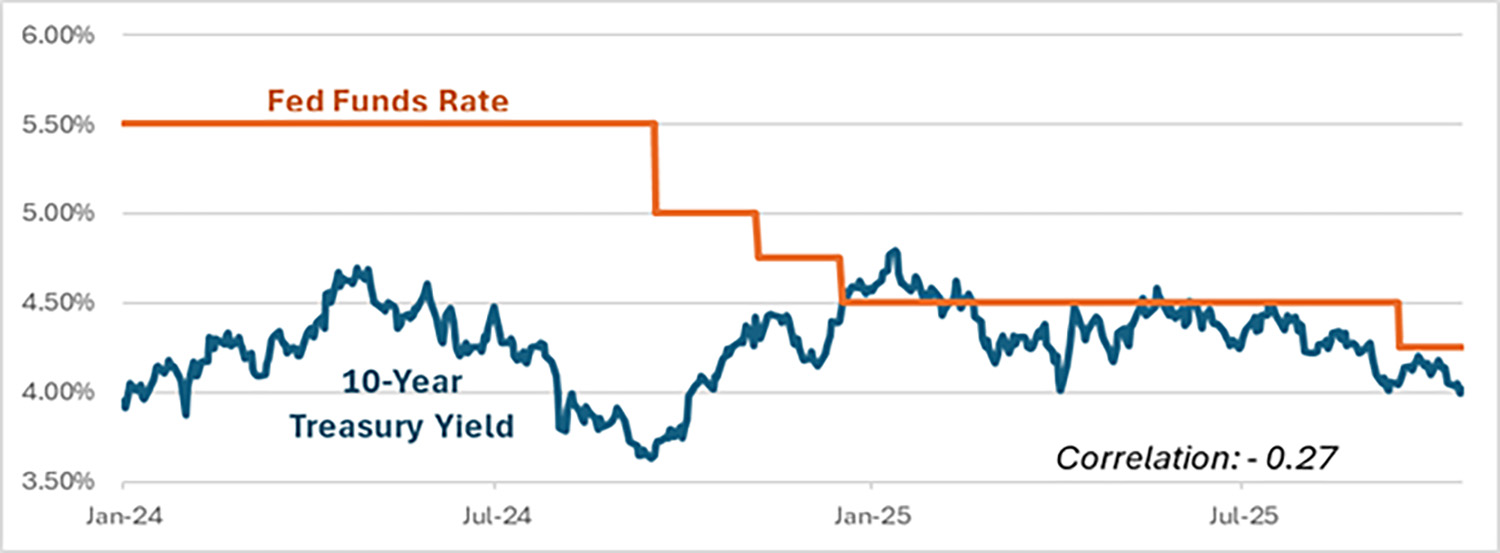

But what about financing costs? While there is a connection between short-term and long-term interest rates, the correlation isn’t that strong in the short term. As such, this profile of investor can’t fully rely on these cuts lowering the interest rate on their next refinance. Looking at the past couple years, there were multiple instances when the 10-yr U.S. Treasury note yield rose while the Fed cut rates - thus resulting in a negative correlation for this period. Over longer periods, the correlation tends to be more positive, but still not super strong. This is because long-term rates are determined by broader expectations of future economic fundamentals, inflation, and risk premia. In other words, the Fed’s moves are only one piece of a much larger puzzle, so this comparison is simply apples-to-oranges.

Developers

CRE Developers and the contractors that rely upon them are poised to benefit considering most construction loans carry floating rates. New construction project economics simply have not worked for the past couple of years with ~8% debt costs, resulting in numerous projects being placed on hold. Lower short-term rates, coupled with regional banks (a primary provider of construction loans) being more active today than in the past couple years, should help spark a resurgence of construction activity, subject to stability in the broader economic environment.

Investors in Troubled or Transitional Assets Using Floating Rate Debt

Fed cuts cannot come soon enough for this category. Bridge loans typically carry floating or very short-term fixed rates and are heavily used by investors who have a value-add business plan or a troubled asset with a maturing loan that no longer underwrites for traditional term financing. Examples are an office building that fell victim to the work-from-home trend or a highly leveraged multi-family property that didn’t achieve anticipated rent increases after a renovation. Many CRE loans, particularly those from banks, carry 5-year terms and five years ago today the 5-yr U.S. Treasury yield was near zero. Therefore, the cost of debt for many of these maturing loans is skyrocketing from, let’s say, ~3.50% when it was a performing asset to ~8% or higher if it now needs a bridge loan. This increase in both the rate index and credit spread devastates cash flow. Office loans are particularly exposed to this risk as occupancy and rent levels are now lower in many cases than at origination and cap rates are higher, all of which has a compounding effect, warranting a much higher credit spread and creating serious refinance challenges. According to the Mortgage Bankers Association, an estimated 24% of all office loans will mature in 2025 (and many of these were scheduled for 2024 but were unable to be refinanced, forcing existing lenders to provide short term extensions). Thankfully, this isn’t an issue at River City Bank, considering office loans only represent 13% of our CRE loan portfolio and the delinquency rate is currently 0%, due to our conservative program that competes with aggressive pricing and exceptional service, rather than risk taking.

So, Fed rate cuts in 2025 are generally positive for the CRE industry, but in my opinion, their overall impact will likely not represent a monumental shift in the CRE landscape simply due to the moderate magnitude of the changes. However, further additional cuts in 2026 could, of course, make a more dramatic impact on the market.