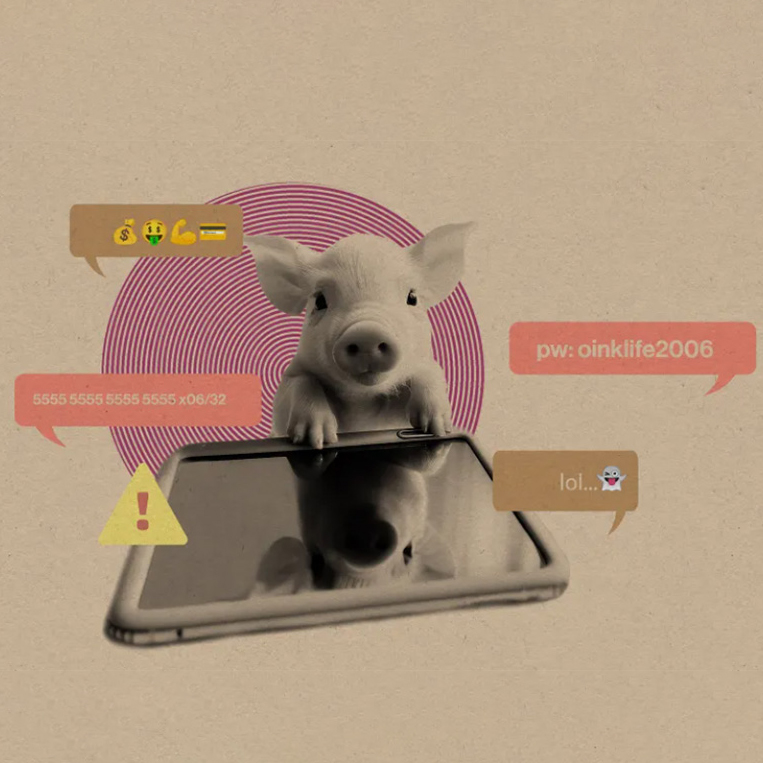

ACH fraud occurs when unauthorized transactions are electronically posted to your account. It is on an exponential rise and starts with just two things: Your business checking account number and a routing number. These two pieces of information are all cybercriminals need to attempt a fraudulent ACH transaction.

According to the Association for Financial Professionals’ (AFP) latest Payments Fraud and Control Survey Report, fraud perpetrators are targeting ACH payment methods more frequently than check and wire transfers. As ACH transactions are typically considered safer and more difficult to compromise, the increased focus on ACH transactions suggests that fraudsters are acquiring more sophisticated techniques when targeting organizations.

Fortunately, there are steps you can take to guard against ACH fraud:

- Monitoring your bank account regularly for unauthorized transactions is one of the best ways to notice potential ACH fraud. Set up account alerts to immediately notify you of any suspicious activity. If you see a fraudulent transaction, report it to your Bank immediately.

- Use ACH Positive Pay. For businesses, this is a service allowing users to review unexpected incoming debits before they’re cleared to post in the bank account.

- Use a secure payment gateway. A secure payment gateway is one of the best ways to prevent ACH fraud. It will encrypt your account information and protect it from unauthorized access.

- Install anti-virus and malware software and keep it up to date. Staying safe online is an ongoing effort, and one of the simplest yet most effective ways to do so is to remain vigilant and keep your devices updated with the latest software. These software updates frequently come with software patches that fix security gaps and prevent a potential hacking effort across multiple logged-in devices. These patches keep one’s device secure and protect it from software holes that give hackers easy access to multiple devices and the data stored within them.

- Be smart when creating passwords. Using secure passwords and PINs to secure your devices is one of the most essential steps taken while using multiple devices. It goes without saying that one must always use different passwords for different devices. Use strong passwords that can’t easily be guessed or decoded using brute force. Only store credentials in official password managers to keep everything secure.

- Make sure websites are secure. A secure URL should begin with “https” rather than “http.” The “s” in “https” stands for secure, which indicates that the site is using a Secure Sockets Layer (SSL) Certificate. This lets you know that all your communication and data are encrypted as it passes from your browser to the website’s server; however, this doesn’t mean that you are connecting to the correct website. Double check the URL to ensure you are going to the correct and intended website.

- Keep your firewall turned on. A firewall helps protect your computer from hackers who might try to access your system to steal your information. Always keep your firewall turned on and up-to-date.

- Stay Educated. Stay Protected. Being vigilant is crucial to being more digitally secure. The best way to do this is to stay updated with the latest developments and be aware of the tactics implemented by those looking to compromise multiple systems. This can also help one spot potential risks and mitigate them before the need arises.

- Verify payment requests. If you receive a payment request, make sure to verify the request before sending any money. Verify the requestor’s identity and ensure you understand the payment’s purpose. If you have any doubts, contact the requestor using a known and verified contact.

- Don’t click on links and open attachments in suspicious emails. If you receive an email from a sender you don’t know, or if the email looks suspicious, don’t click on any links or open any attachments. They can be malicious and lead you to a website that will steal your information or compromise your device

- Refrain from trusting a sense of urgency. Scammers often try to create a sense of urgency to get you to act quickly. Don’t let yourself be pressured into making a decision; take the time to verify any payment requests.

When it comes to preventing ACH fraud, it takes a village. We can only win this battle by implementing various layers of internal controls throughout the funds transfer process. If you believe you or your business is a victim of ACH fraud, contact us immediately to halt additional fraudulent transactions. Also, consider reporting the incident to law enforcement, which helps your business and others avoid similar fraud attempts.

Should you have any questions regarding your personal or financial information at the Bank, please do not hesitate to contact a Customer Service Representative at (916) 567-2899 or (800) 564-7144 or by email at [email protected].