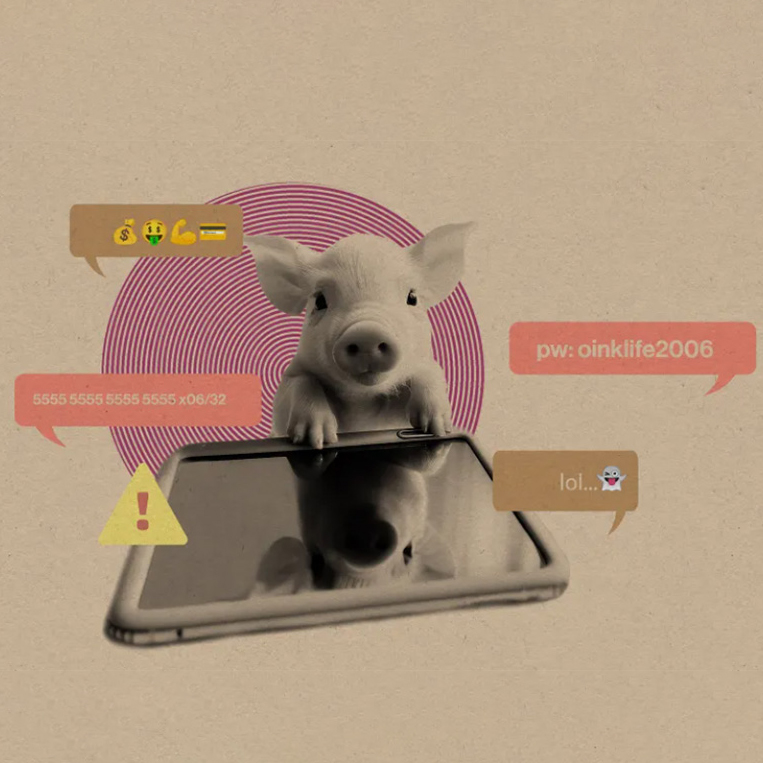

Wire Fraud is on the rise, but it is preventable. Whether you’re managing business or personal accounts, verification is key to making sure the right person is receiving your money.

Before you initiate a transaction, ask yourself these questions:

- Is this an entity or person you normally make payments to via wire?

- Are the payment instructions different than in the past?

- Have you spoken directly with your payee regarding the change/request? It’s the best way to ensure the change/payment request is valid.

Creating and following a wire verification process is essential to protecting yourself and your business. Do not take shortcuts and fall victim to fraudsters. You can outsmart them by carefully reviewing wire requests and following the process.

Customers cumulatively lost almost $200,000 this month alone by not following a wire fraud verification process. In all cases, the customers did not call back the beneficiary with the phone number on file to verify the wire transaction.

We’re all in this together to prevent electronic transaction fraud. We can only win this battle by implementing various layers of internal controls throughout the funds transfer process. If you believe you or your business is a victim of wire or ACH fraud, contact us immediately to halt additional fraudulent transactions. Also, consider reporting the incident to law enforcement, which helps your business and others avoid similar fraud attempts.

Should you have any questions regarding your personal or financial information at the Bank, please do not hesitate to contact a Customer Service Representative at (916) 567-2899 or (800) 564-7144 or by email at [email protected].