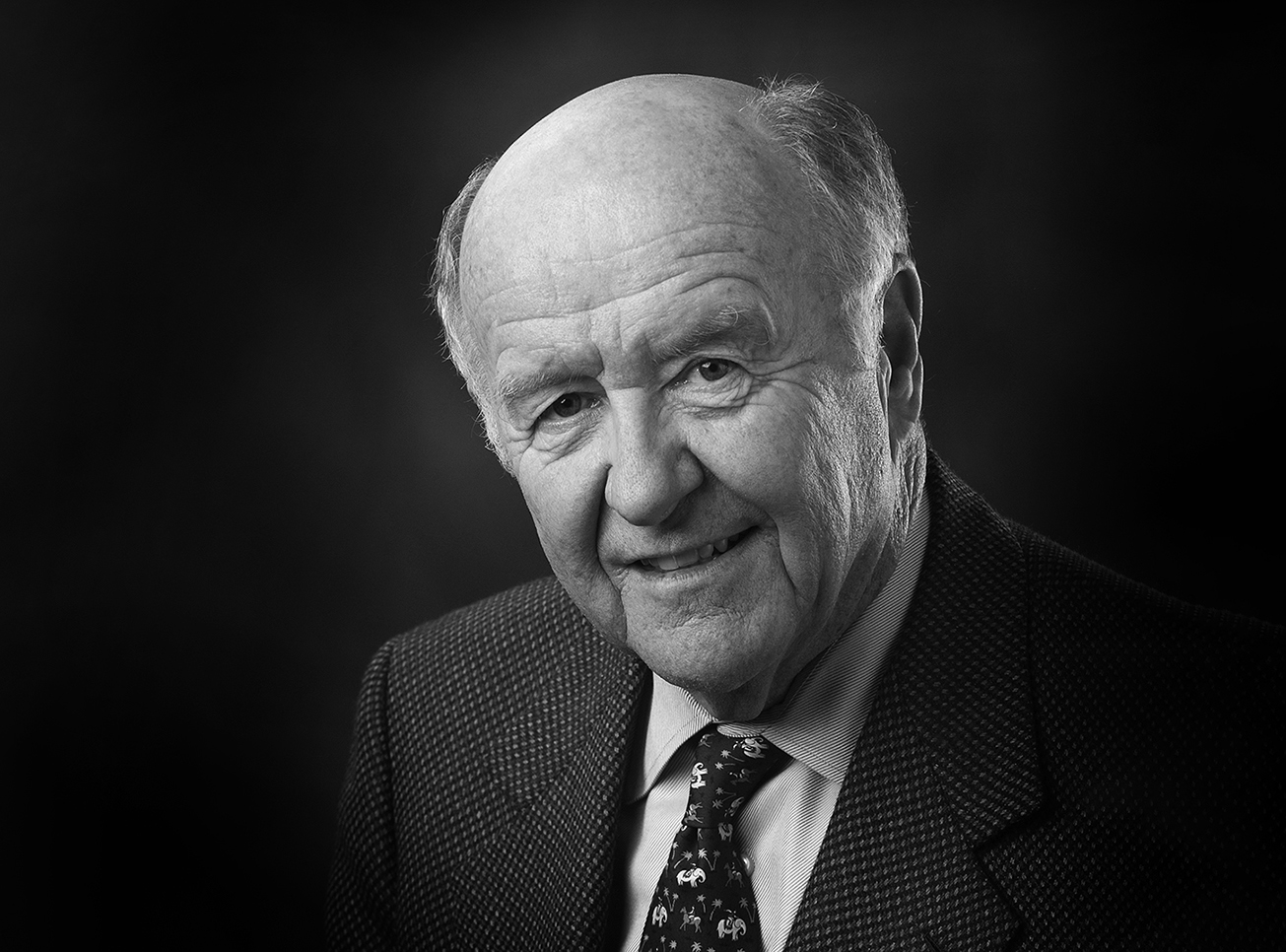

This inaugural, peer-nominated award recognizes CEOs from the Sacramento region who have made a positive impact both within their respective businesses and the community as a whole. Steve Fleming is one of 25 recipients of the 2020 Most Admired CEOs award from Sacramento Business Journal.

Sacramento, CA – Steve Fleming, President and CEO of River City Bank, has been named one of Sacramento’s top leaders as a member of the inaugural class of Most Admired CEOs from the Sacramento Business Journal. The first annual event recognizes Sacramento CEOs who have made a positive impact through their dedication and leadership both within their business and in the local community as a whole. Recipients of this award were nominated for the distinction by their peers in the Sacramento business community.

“Since stepping in as President and CEO of River City Bank in 2008, Steve has evolved the way we do business and enhanced our community-focused initiatives throughout the Sacramento region while also expanding our footprint into promising nearby markets,” said Shawn Devlin, chairman of the board at River City Bank. “His leadership has made the difference between success and failure for many of our community’s important businesses, particularly during the difficult times we’ve faced due to the COVID-19 pandemic. I am pleased to congratulate Steve for this first-of-its-kind distinction, on behalf of the board of directors and the entire River City Bank team.”

In addition to driving strategy and execution at River City Bank, Fleming serves as a leader in various philanthropic and economic organizations, and he spearheads community-focused initiatives throughout the Sacramento region. He is President of the board for the Capital Region Family Business Center, President of the Sacramento chapter of Lambda Alpha International, and a member of the Sacramento Host Committee. He is also on the Board of Directors of the Kelly Foundation and the Greater Sacramento Area Economic Council.

Fleming has more than 35 years of banking experience, including more than 20 years with Bank of America in Sacramento and London, England. Immediately prior to joining River City Bank, he was the Founder and CEO of Presidio Bank in San Francisco. He was also the President and CEO of National Bank of the Redwoods in Santa Rosa. Under Fleming’s leadership, River City Bank has quadrupled in size from $800 million to $3.2 billion in total assets.