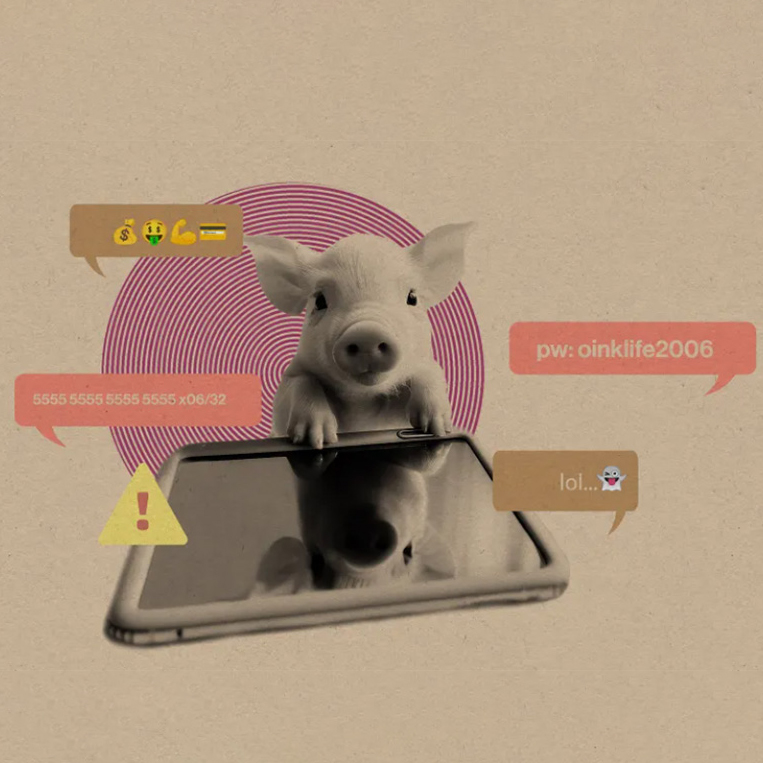

In 2023, the Financial Crimes Enforcement Network (FinCEN)[1]." issued a critical alert about a virtual currency investment scam known as "Pig Butchering." According to most recent estimates, pig butchering schemes cost victims $3.3 billion in 2022, the most recent year that data was available.

What is "Pig Butchering"?

Pig butchering is a type of online investment fraud where scammers create fake personas to trick victims into fraudulent investment schemes by building trust over time. Scammers use various tactics to deceive victims into parting with their money. They establish an emotional connection and gain the trust of their victim over the long term. Unlike other scams that involve smaller, frequent transactions, pig butchering typically aims for a large, single payday that can drain victims' life savings.

Charcteristics of Pig Butchering

- Gaining trust: Scams often begin with casual conversations initiated by the scammer, who may pretend to have received the victim's contact details accidentally or through a mutual acquaintance. These initial interactions are designed to build trust and may involve the use of attractive profile images to lure victims.

- Introducing the investment: As trust is established, the scammer introduces the victim to a fraudulent investment scheme, promising significant returns in a short period. The scammers use persuasive tactics and counterfeit investment portfolios to convince victims of the scheme's legitimacy.

- Collecting money: After convincing the victim to invest, scammers collect funds, often through digital payment platforms or cryptocurrencies, to complicate tracking and tracing of the transactions.

- Disappearance of the scammer: Once a substantial amount has been collected, or when victims attempt to withdraw funds, scammers become unreachable, delete their online presence, or create new identities, leaving the victims with no way to recover their funds.

Investors need to be vigilant and conduct thorough due diligence before investing in cryptocurrency or any other investment scheme. Be wary of unsolicited investment offers and approach overly promising investment proposals skeptically. Review these actions to protect yourself:

- Be careful who you trust: Fraudsters do their best to create emotional connections with their victims. Think critically before letting your guard down with someone you just met. They use your social media information and anything they can get you to share to manipulate and take advantage of you.

- Beware of red flags: Never rush into any investment. Only use well-known and reliable trading platforms, including Cryptocurrency exchanges.

- Don’t fall for FOMO: Fraudsters try to get victims to feel the Fear Of Missing Out (FOMO). Be very skeptical if a new acquaintance tries to get you to invest fast so you don’t miss an opportunity. That is often a trick to get you to give them money before your judgment kicks in.

- Trust your instincts: Think twice before investing - if it seems too good to be true, it probably is.

- Keep your information to yourself: Do not provide details about your financial positions or share sensitive information online or on unverified sites.

- Verify Information: Validate individuals you meet online are trustworthy through mutual friends or acquaintances. Verify investment opportunities by conducting independent research and seeking advice from trusted financial professionals to ensure legitimacy.

Be Cautious and Conduct Your Due Diligence

"Pig butchering" continues to pose a significant threat to investors. Don’t make rash financial decisions with too-good-to-be-true promised results with people you meet online. If you suspect you are involved in a cryptocurrency scam or fraudulent activity, immediately report it to authorities and your financial institution. Always be cautious and conduct due diligence when considering investment opportunities.

[1] FinCEN is a bureau of the U.S. Department of the Treasury. FinCEN’s mission is to safeguard the financial system from illicit use and combat money laundering and promote national security through the collection, analysis, and dissemination of financial intelligence and strategic use of financial authorities.